A new study by Stone Center Assistant Research Professor Joe LaBriola published in the journal Social Problems reveals that housing market appreciation has significantly contributed to the widening wealth gap between White and Black households over the past four decades.

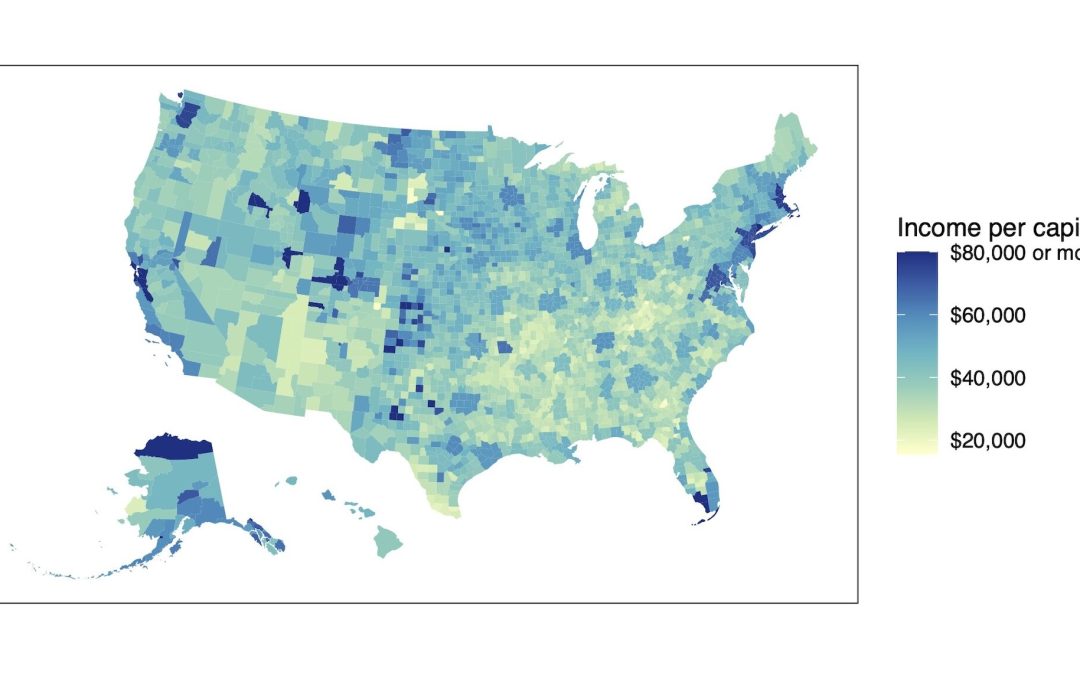

LaBriola’s research, utilizing data from the University of Michigan’s Panel Study of Income Dynamics (PSID), demonstrates that most of the growth in the median wealth gap between White and Black families can be attributed to housing market trends. Specifically, the study found that rising house prices have disproportionately benefited White families over Black families, due both to White-Black gaps in homeownership and to greater average house values among White homeowners compared to their Black counterparts.

“Real national house prices grew by 55% from 1984 to 2021, driving substantial wealth gains to homeowners,” LaBriola explained. “However, White families saw more significant wealth benefits from house price growth than Black families. My research finds that housing market appreciation explains much of the growth in White-Black wealth inequality over this period.”

Using data from the PSID, LaBriola created counterfactual trajectories to model how the White-Black wealth gap would have evolved without the effects of local housing market appreciation. The results are striking: under this counterfactual, the median White-Black wealth gap would have grown by only $22,750—approximately 30% of the actual observed increase—suggesting that housing market appreciation accounted for most of the growth in this disparity.

Key Findings:

- Homeownership Rates: Approximately 70% of White families own homes compared to just 40% of Black families. These homeownership disparities are the largest reason why White households have received greater wealth benefits from housing market appreciation than Black households.

- Local Market Trends: However, local deviations from national housing trends benefited Black homeowners more than White homeowners, suggesting that gentrification in Black neighborhoods boosted wealth for existing homeowners.

- Relative Wealth Gains: Additionally, Black households saw more significant relative wealth gains (as a percentage of their existing wealth) from housing market appreciation than did White households.

LaBriola said that historical policies that impeded Black homeownership have prevented Black households from fully benefiting from recent housing market appreciation. He underscored the need for policy changes to address these inequities.

Policy Recommendations:

- Reforming Housing Regulations: By easing restrictions to allow more housing development, cities can help alleviate supply constraints that drive up prices.

- Implementing Land Value Taxes: Current property tax regimes discourage landowners from residential development that would increase their tax base. By only taxing land instead of the buildings on the land, cities can incentivize landowners to build more housing.

- Subsidizing Homeownership: While subsidies have the downside of potentially inflating house prices, they could help more Black households benefit from housing market appreciation.

Joe said that living in the expensive Bay Area housing market in graduate school sparked his interest in the effects of rising house prices on various forms of inequality. In addition to affecting racial wealth inequality, rising house prices cause renters to spend more of their income on rent, and may also force renters to live in lower-quality housing.

As LaBriola continues his work, he emphasized the need to consider second-order effects of changes in housing wealth, including how housing wealth may affect consumption differently based on wealth and race, and how housing wealth may allow parents to facilitate their children’s transition to homeownership in unaffordable housing markets.

Visit the article for detailed insights and access to the full study.

About Joe LaBriola:

Joe is a Research Assistant Professor at the University of Michigan’s Survey Research Center, where he is also faculty at the Stone Center for Inequality Dynamics. Joe uses survey and administrative data to examine the roots of racial and socioeconomic inequalities in the contemporary United States. Currently, his research primarily focuses on racial inequalities in housing and wealth.

Joe has also published on the causes of class gaps in parental investments in children, and in exposure to precarious working conditions. Learn more about Joe by visiting his website.